January marked the 18th consecutive month of growth for the air cargo industry, but the rate of improvement continues to decelerate and yields and cargo load factors are down.

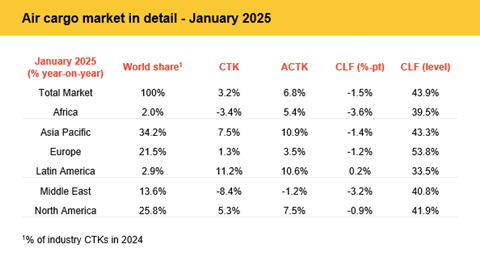

Total demand, measured in cargo tonne-kilometers (CTK), rose by 3.2% compared to January 2024 levels, the latest data from IATA shows. However, growth rates have been decelerating since September.

Capacity, measured in available cargo tonne-kilometers (ACTK), increased by 6.8% compared to January 2024. Meanwhile, Cargo Load Factor (CLF) declined to 43.9%, the lowest in 17 months.

“January marked 18 consecutive months of growth for air cargo, but the month’s 3.2% year-on-year growth is a moderation from double-digit peaks in 2024. Similarly, yields, while still above January 2024 levels, saw a 9.9% decline from December as cargo load factors also declined by an average of 1.5 percentage points,” said Willie Walsh, IATA’s director general.

“While external factors such as trade growth, declining fuel costs and expanding e-commerce remain positive for air cargo, it is important to closely watch the evolution of market conditions at this time. In particular, the wild card is the potential for tariff-driven trade policies from the US Trump Administration. Fortunately, the air cargo industry is well practiced at dealing with shifts in the operating environment.”

Looking at the wider operating environment, IATA noted both economic growth and inflation.

Year on year, industrial production rose 2.6% in December. Global goods trade grew for a ninth consecutive month, reporting a 3.3% increase in December.

The Purchasing Managers Index (PMI) for global manufacturing output was above the 50-mark for January, indicating growth. At 50.62, this was the highest reading since July 2024, said IATA. The PMI for new export orders rose to 49.37, remaining just shy of the 50-mark, which is the growth threshold.

In January, consumer inflation in the US and in Europe both rose by 0.1 percentage points to 3% and 2.8% respectively. Chinese consumer inflation rebounded to 0.5% in January, after progressively falling to 0.1% in the previous four months.

Regionally, IATA said most international routes experienced growth in January and airlines are benefiting from rising e-commerce demand in the US and Europe, amid ongoing capacity limits in ocean shipping.

Latin American carriers reported the largest year on year air cargo demand increase in January, with an 11.2% improvement. Capacity increased 10.6% year on year.

Asia-Pacific airlines recorded 7.5% growth and capacity was up 0.9%. North American carriers noted a 5.3% increase, while capacity grew by 7.5%.

European carriers registered demand growth of 1.3% for the month and capacity increased 3.5%.

However, there were cargo traffic decreases recoded for Middle Eastern and African airlines.

African airlines saw a 3.4% decrease in demand and capacity increased by 5.4%, while Middle Eastern carriers registered an 8.4% demand decrease, the slowest among the regions. Capacity decreased by 1.2%.

IATA pointed out that the declines reflect a spike in demand this time last year.

"The global market expansion faced headwinds from reduced activity in Africa and the Middle East during January 2025, following their exceptional performance in 2024, as African carriers grew at 15.9% and Middle Eastern ones at 26.2%, likely influenced by the Red Sea situation."