Kuehne+Nagel (K+N) and DSV highlighted a complex logistics market in their recent quarterly updates, with higher freight rates to stay, softening consumer demand and ongoing supply chain disruption.

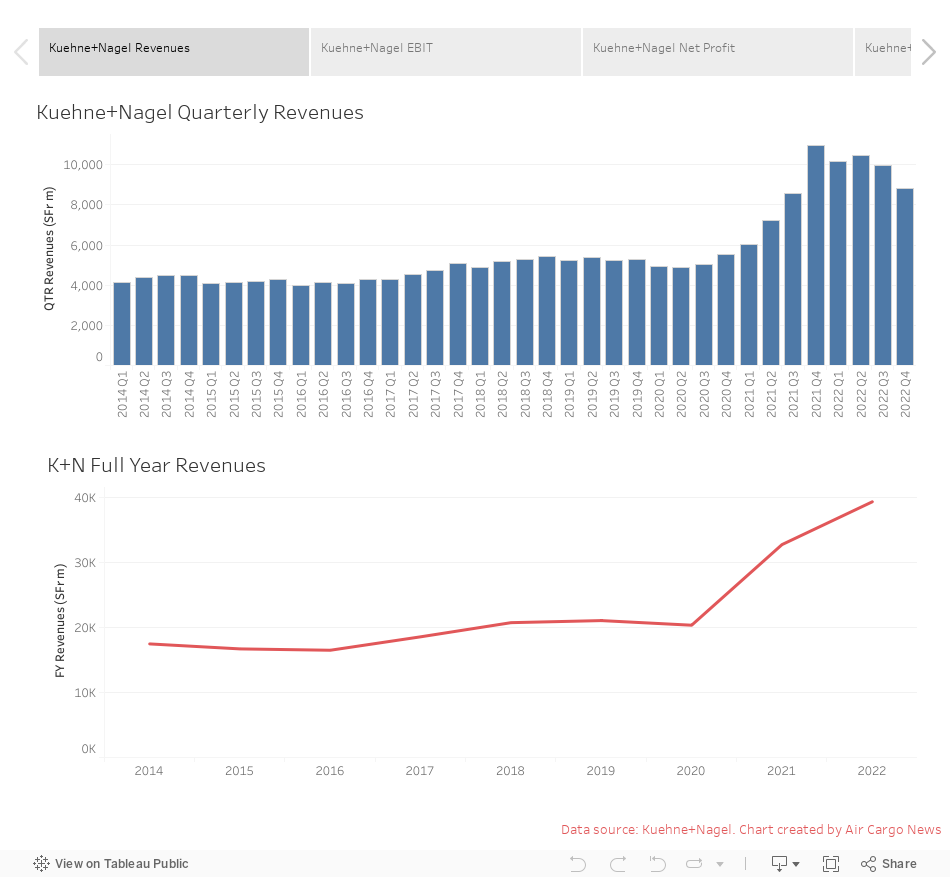

K+N was the first to reveal its results, with revenues and profits continuing to surge on the back of acquisitions on higher prices in the market.

On the demand side, the firm's chief executive Detlef Trefzger pointed out that GDP was now expected to grow at around 3.5%, down from more than 6% last year, as consumers are hit by a surge in the cost of living and uncertainty.

Meanwhile, the opening up of the service sector is expected to divert some consumer spending away from goods and onto services.

However, he stressed 3.5% growth was hardly a decline and that the move to services spending would also fuel some demand.

“[Last year] everybody was investing in refurbishing their homes, bathrooms, living rooms and so on,” he said.

“But that consumption has changed, there's a slight opening up after the pandemic. Already, by middle of quarter three, we have seen a consumption pattern skewed towards service industries again and this is at the moment continuing.”

He added: “We are talking about a GDP growth of 3.5%, ladies and gentlemen. No we are not talking about a depression, we're not talking about negative GDP growth.

“And I think that's a very fair and reasonable assessment of the second semester at the moment, unless [there is] something more disruptive or more unpredictable.”

Trefzger said that pharma and aerospace demand had been growing at double-digit levels while there was bottlenecks in the automotive sector due to chip shortages.

DSV also saw its profits and revenues surge in the first quarter. Chief executive Jens Bjorn Andersen agreed that there had been a switch to service spending and that there was variations depending on the vertical.

“It is a mixed picture,” he said. “Some industries suffer from lack of microchip's, from lack of components. And others are maybe also suffering a little bit from lack of demand.”

He added: “It seems like world GDP will grow faster now this year, than what it did in 2019. So it's not like it's going in reverse or anything.”

Andersen felt the current market disruption - caused by ongoing ocean congestion, the Shanghai lockdown and the war in Ukraine amongst others – would continue.

“The markets are still characterised by disruptions in the supply chain most recently by the lockdown in Shanghai,” said Andersen.

“And we do not believe that we will see a very big change in the disruption even if we get to the later part of this year.

“It's not unlikely that the whole of 2022 will be characterised by these challenges that we have been facing at the beginning of the year.”

Focussing on the Shanghai lockdown, Trefzger expected that when the lockdown is eased production would quickly ramp up - within weeks - and how quickly supply chains from the city returned to normal levels depended on how fast carriers could re-add capacity back into the market.

He added that a new lockdown could be coming in Beijing as cases are on the rise in the city, which could affect manufacturing in the greater Beijing area.

Inventory levels are a key indicator for future air cargo demand and Andersen said that there would be an element of re-stocking at some point, especially given an expected surge to meet the Shanghai backlog.

“If you look at the inventory level in European Union with the retailers, I think the situation is that many of the retailers they still need to stock up. They're running on very low into inventory levels,” said Andersen.

“I hear that the inventory levels are little bit higher in the US, so it's little bit different. Right now there is a backlog of that needs to be shipped.”

On overall freight rates across modes, both expect them to soften in the future, although not to pre-pandemic levels.

“We will be not estimating that yields will go back to anywhere near where they were before,” Andersen says.

“They will find a place between where they are now and what they used to be and where that exactly is, it's just impossible to say.”

Trefzger said: “We all have to assume significantly higher average freight rates in this decade than during the previous decades because there is a lot of investments to be taken into port infrastructure, into railways, roads to the trucking infrastructure, digitalisation, connectivity, data, connectivity, airports and so on and this will require investments and costs that have to be covered.”