French shipping giant CMA CGM on Tuesday (April 18) announced that it had tabled a bid to take over family-owned Bolloré Logistics in a deal estimated to be worth around $5.5bn.

Following the news of the potential acquisition, the Bolloré Group revealed that the takeover could see its logistics business combined with that of CMA CGM's CEVA Logistics.

"The current prospects for freight demand impel us to be a global player, with a worldwide geographical footprint and local expertise," the group said in a statement.

"We are committed to support our customers in their international development by delivering tailor-made, competitive, agile, and innovative solutions.

"The joining of Bolloré Logistics’ and CEVA Logistics, a subsidiary of the CMA CGM Group, owing mostly to the complementarity of their activities and networks, would pursue these same objectives."

In 2021, the latest figures available from consultant Armstrong & Associates, showed Bolloré Logistics ranked number 10 in terms of annual airfreight volumes with 656,000 tonnes, while CEVA occupied the number 14 spot with 474,000 tonnes.

If the two companies were to be combined, airfreight volumes would reach 1.13m tonnes (based on 2021 volumes).

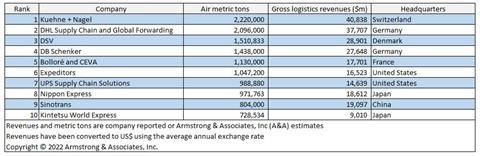

This would make the combined entity the world's fifth-largest airfreight forwarder, knocking Expeditors out of the top five and closing the gap on the leading four forwarders: Kuehne+Nagel (2.2m tonnes), DHL Global Forwarding (2.1m tonnes) and DB Schenker (1.4m tonnes).

In terms of total 3PL revenues, the combined entity would rank number eight in the world with revenues of $17.7bn, based again on Armstrong & Associates figures for 2021.

CEVA Logistics currently ranks number 10 on this list while Bolloré is at number 27.

The rankings could, of course, be affected by last year's performance where European firms were more affected by inflation and the Ukraine war than elsewhere in the world, while there would no doubt be some customer attrition caused by the merger.

There is also the possibility that the deal might not go ahead.

The negotiations do not guarantee an acquisition will take place, the CMA CGM Group noted.

Explaining the logic behind the move, the shipping and logistics group explained: “The negotiations are in line with the Group’s long-term strategy, based on the two pillars of shipping and logistics. The Group’s strategy is to offer end-to-end solutions in support of its customer’s supply chain needs.”