Growth in longer term contracts between shippers and freight forwarders may reflect moves by the latter to secure air cargo volumes, according to CLIVE Data Services.

This shift could indicate a ‘hunt for volume’ by forwarders, said Niall van de Wouw, chief airfreight officer at CLIVE's parent firm, Xeneta.

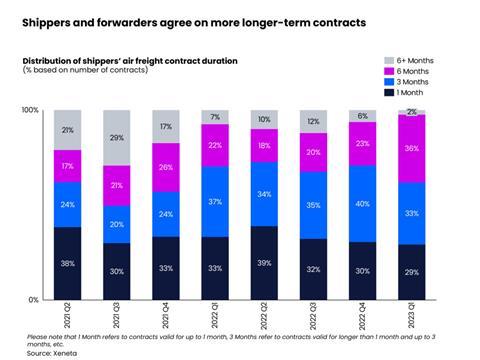

The distribution of shippers’ contract duration in the first quarter of 2023 saw the number of six-month agreements rise to 36% versus 23% in the fourth quarter of last year.

Longer term contracts between shippers and freight forwarders may signal ‘more common ground’ in a stabilising global air cargo market, according to CLIVE.

“I think we’re seeing signs that some forwarders are willing to take a little more risk on what airfreight rates might do because they don’t expect the market to drop much further. Everybody wants to achieve growth, but if the market is not growing, you have to grab a share from someone else," said van de Wouw.

"The fact that we see longer term contracts between shippers and freight forwarders is a signal that the market is stabilising. Shippers have regained some ground because of the lower rate conditions, which have affected the airlines and forwarders, but it’s not like the bloodbath we see in the ocean market,” he said.

Global cargo volumes have been falling for the past 13 consecutive months but in March volumes registered a 3% fall compared with last year, the lowest monthly decline in over a year, according to CLIVE.

International cargo capacity continued to recover in March, recording an increase of 16% from a year earlier.

In March, the load factor of 60% was six percentage points adrift from the same month a year earlier but recovered six percentage points from the seasonal low in January this year.

The 38% reduction in the general airfreight spot rate year on year produced an average rate of $2.62 per kg. This figure represented a 4% decline over February.

The rate fall is attributed to both shrinking cargo volumes and recovering cargo capacity.

The company said the "previously resilient" transatlantic westbound air cargo trade registered its first year-on-year volume fall of 11% in March.

March volumes out of mainland China grew 30% from last month and were down only 2% from a year earlier. But the growth of air cargo capacity outpaced the growth of volumes, said CLIVE.

CLIVE noted retailers now fear a slower and subdued market as a result of reduced consumer spending, meaning restocking and the peak season airfreight windfall this usually creates may not materialise.

However, van de Wouw commented: “We don’t see an airfreight market in crisis, we see it finding a new baseline, which we referenced last month when we acknowledged the need to move on from pre-Covid comparisons.

"If we are seeing a shift to longer term contracts, this will certainly benefit shippers’ logistics purchasing departments which, due to the level of volatility in the industry, have been forced away from traditional annual deals.

"Their core business is making pills or smartphones, for example, and not about having to renegotiate airfreight rates every week or every month. We see a calming down and a greater appetite for shippers and forwarders to come together on a longer term. There’s more common ground for longer-term deals in a positive way.

"The next interesting market development is what airlines do with their summer schedules and the further capacity boost this traditionally brings?”